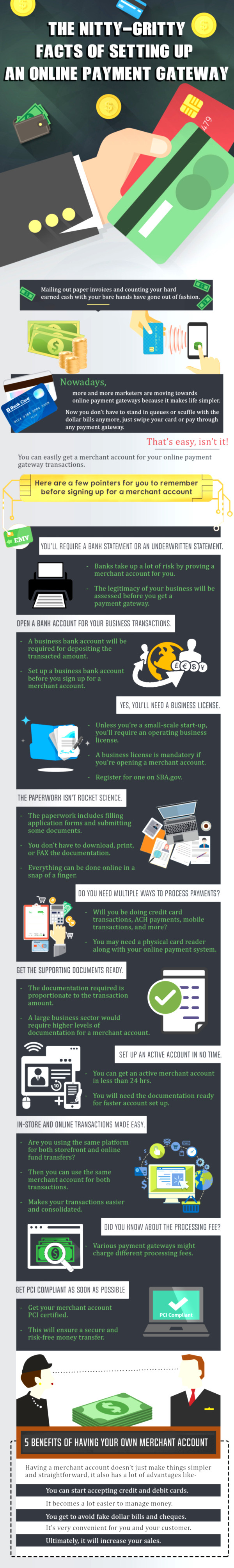

Are you planning to expand your business? Tired of all the paperwork? Well, it’s high time to start accepting payments online. Mail and other paper bills might slow you down and keep you away from growing your business. Every small entrepreneur out there who wants to accept credit card payments opened a merchant account for their business. In order to stay ahead of them all and make your transactions simpler, all you need to do is just open a merchant account of your own.

But, before you get started, you definitely need to know about the ins and outs of opening a merchant account. If you’re new to online merchandise, here’s a list of 10 important things that will help you set up a best merchant accounts:

- Underwriting is absolutely necessary; all you need is a little guidance.

Providing merchant account for business involves a lot of risk, especially for the payment processing gateways and their affiliating banks. Every dollar that you transact through their payment gateway could be charged back and the bank would be deemed responsible for the resource. This makes underwriting an absolute necessity.

The banks will assess the risk associated with opening a new merchandise account and the legitimacy of your business. Depending on their assessment they will help you set up a merchant account with them.

- You need an exclusive business bank account.

Even if you’re the sole owner of your company, you’ll need a separate business account for opening a merchant account. A business bank account can be opened with any bank, if you have the Employer Identification Number (EIN) and business license ready. All the transactions that you do using your merchant account will be debited to your business account.

- Of course, a business license is mandatory for a merchant account.

A business account is something that’s you’ll need for undeterred business operations and to have an ownership over your business. Unless you’re a start-up testing out your business plants, you probably need a business license for operating in a province. If you don’t have one, register with your Secretary of States Website at the earliest.

- The preps are pretty simple, can even be completed online.

Opening a merchant account is very simple if you’re aware of the procedures. You can simply fill out the online application and save your time printing and mailing the hand written application. You’ll need certain documentations, like EIN, business turnover, tax ID, and many others along with a business account number for filling an online merchant account application.

- Separate merchant accounts would be needed for different types of payments.

Are you planning to accept credit card processing, ACH payments, mobile transactions, and more for your business? Then you’ll need a separate merchant account and underwriting procedures for each type of transactions. You can still get all this all done with a single application, just by selecting the number of payment types in your merchant account application form.

- Yes, you need supporting documents depending on transaction volume.

If yours is a small scale sector that processes only a couple of thousand dollars a month, you would require only a few marketing material and documentation, like a voided check. But, if you are in need of processing larger amounts, you’ll require several supporting documents, like financial information, bank statements, and more.

- All it takes is one business day to get your account up and running.

Setting up a merchant account wouldn’t take much time, unless you don’t have the required documentation. Once your application is accepted, you’ll be asked to submit the required documents. When you get through these processes, you can have your account set up. All it takes is one business day, if you have all the documentations at ready.

- The same merchant account can be used both for your store and online merchandise.

You can use your merchant account for both online transactions and physical storefront, as long as you are using the same online platform. If you’re using the same TYSYS platform for all kinds of transactions, then you can link the same merchant account for your funds transfer. This makes your mobile payments and other electronic payments much easier and consolidated. You can also save another round of underwriting that would be required for setting up a new merchant account.

- Get to know about the varying processing fees.

One thing to keep in mind is the varying processing fee and funding times associated with your transactions. Your echeck or ACH processor may charge a specific transaction rate and your credit card processer would charge a different rate along with an additional percentage fee. The processing fee would, eventually, vary for different means of transitions and also vary over a timeline. Make sure you know the all processing fees before setting up a merchant account.

- PCI compliance can validate for a safe transaction.

The credit card handling companies have set a PCI standard called the Data Security Standard (DSS) that ensures the safety of your transactions. While opening a payment gateway it’s not mandatory that you need PCI compliance, but you would require one sooner or later to ensure that you are transactions are being securely processed.

If you’re a trader who means business, then a merchant account means more than just a status symbol. You’ll definitely need one for setting up a savvy and solid long-term business plan. If you don’t have a merchant account, there’s no better time than now to set up a transaction account!

This is super great!! :)! I love this..!-