Financial wellness is a feat that everybody aims to accomplish. The ability to provide your loved ones with everything they need and the feeling of being able to deal with expenses seamlessly is an achievement unlike any other.

However, monthly bills, day-to-day spending, and unforeseen emergencies may come into play and prevent you from acquiring the maturity you want. At the end of the day, this makes the process of attaining complete financial independence easier said than done.

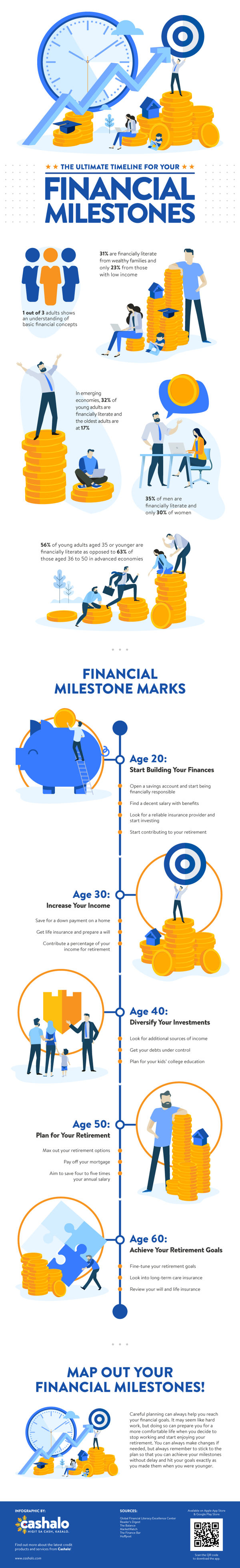

Due to the high number of financially illiterate people all around the globe, many individuals are not able to experience the joy of being financially independent. In fact, studies show that only one out of three adults have basic knowledge regarding fundamental financial concepts.

When it comes to saving, your approach towards money will end up being the defining factor for your long-term stability. No matter how much you’re earning from your business or monthly salary, lacking the proper amount of financial knowledge and discipline will make it difficult for you to achieve your goals.

Once your negative habits, expenses, and all other costs come into play, relying too much on your paycheck may prevent you from making the most out of what life has to offer. If you want to take constant steps towards financial wellness, you’ll need to follow a set timeline to manage your finances effectively.

This is why everyone needs to set financial milestones.

May you be a salesman, a doctor, or an engineer, you should always remember that the first step towards any successful project is to create clear, realistic, and well-defined goals. By setting financial milestones and the necessary deadlines, you’ll have a guide that will help you manage your money well.

Take a look at this infographic for your ultimate guide to setting your financial milestones.