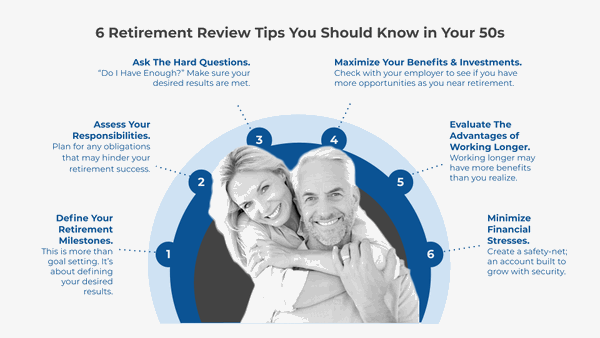

Are you 50 or older or approaching 50? Now might be the time to take a good long look at your retirement plan. As you get older it is important to make sure that everything is in the right place to ensure that you have the happiest retirement possible. But what does looking at retirement even really look like? We’re here to help. Here are six tips and a wonderful infographic to help you make sure you’re on the right path to a successful retirement.

The six tips that you need to take into account as you enter your 50s are as follows:

- Think about retirement milestones

- Assess your responsibilities

- Ask yourself if you can make ends meet

- Should you maximize your benefits and investments

- Consider working longer

- Plan for financial stresses

Thinking about your retirement milestones is easy. All you have to do is plan out the big things you want to do when you retire. Do you want to travel the world? How much do you think it’s going to cost to do so? Think about these things before you retire to ensure that you’re saving enough money to fund these events.

The next tip is to assess your responsibilities. When assessing your responsibilities you will need to consider what kind of obligations you may have when you retire. Will you still be paying off your mortgage? Do you have adult children that will need your financial help? Think about these things to gain perspective on the amount of money you may need on an annual and monthly basis.

Next you will need to ask yourself if your retirement can meet your obligations and milestones. Draw up a monthly budget based on your retirement funds and potential Social Security benefits. If you when you create your budget you have little to no money left over you may need to move on to the next step.

The next step is to consider maximizing your benefits and investments. For example, did you know that as you age you can invest more money into your 401(k)? Speak with an investment specialist to see if you can benefit from increasing your investments.

Another tip that you can consider is asking yourself if you might be interested in working for a longer time period than you had originally planned. Not only will this help you to save more for your eventual retirement, but it can also help you maintain your mental and emotional health.

Finally, the last step is to plan for financial stressors. Financial stressors are all the unforeseen events that might happen as you age. What if you get sick? Do you have a fund or insurance package in place that will help pay for long-term care? Consider investing in these packages.

After you’ve asked yourself these questions, you should be set to improve your retirement plan to better meet your needs.

Info From: https://www.tyjyoung.com/2021/02/27/6-retirement-review-tips-you-should-know-in-your-50s/