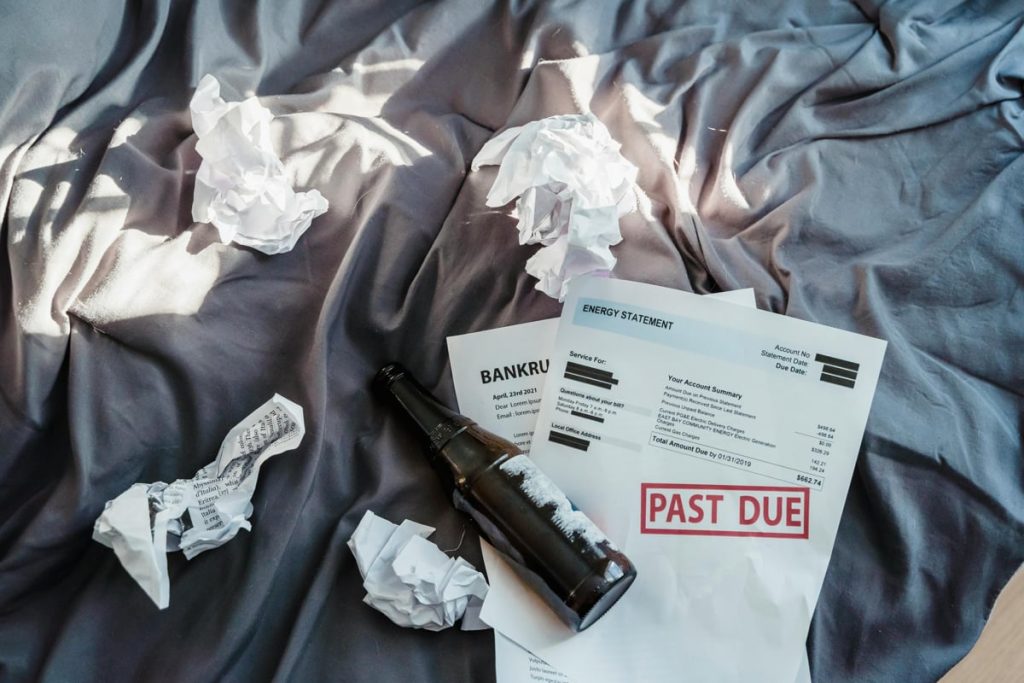

Managing debt can feel overwhelming, especially when financial obligations start to outweigh resources. For individuals and businesses facing financial difficulties, strategic debt resolution offers a roadmap to regain control of finances. This blog will explore how guidance from experienced bankruptcy attorneys can offer insights and solutions for navigating the complexities of debt reorganization.

Discover how to strategically tackle debt, understand the role of expert legal guidance, and regain financial stability through a comprehensive approach to debt resolution.

Understanding Strategic Debt Resolution

Debt resolution involves developing a practical plan to manage, settle, or discharge your financial obligations. Unlike short-term fixes, strategic debt resolution focuses on long-term stability by addressing your unique financial situation. An effective strategy considers aspects like cash flow, upcoming financial obligations, and available options under the law.

Bankruptcy attorneys bring invaluable expertise to this process, as they can identify appropriate strategies tailored to the circumstances of individuals or businesses. While bankruptcy is one potential solution, attorneys can also recommend alternatives, such as debt negotiation, consolidation, or repayment plans.

Key Benefits of Strategic Debt Resolution

Reduced Financial Stress

Financial difficulties often create significant emotional and mental pressure. A structured approach to resolving debt helps alleviate this stress by addressing these challenges head-on, providing a sense of control amidst uncertainty.

Preservation of Assets

Debt resolution strategies often aim to preserve as many assets as possible while meeting legal requirements for repayment. This benefit is especially crucial for businesses trying to stay operational during financial rough patches.

A Clear Roadmap to Recovery

With the guidance of bankruptcy attorneys, debt resolution becomes more predictable and manageable. An experienced legal professional ensures that every step aligns with your long-term goals and protects your rights.

Roles of Bankruptcy Attorneys in Strategic Debt Resolution

Expert Legal Counsel

Bankruptcy attorneys specialize in debt law, offering a wealth of knowledge in bankruptcy attorney services to guide individuals and businesses through creditor negotiations, court proceedings, and repayment plans. They not only protect clients’ interests but also ensure compliance with complex legal regulations.

Comprehensive Financial Assessment

A comprehensive analysis of income, debts, and assets lays the foundation for any strategic debt resolution plan. Attorneys thoroughly evaluate financial data to determine viable options, such as bankruptcy filing or alternative settlement plans.

Filing for Bankruptcy

When bankruptcy emerges as the best course of action, attorneys assist with filing for Chapter 7, Chapter 11, or Chapter 13 bankruptcy as applicable. They also help clarify the implications of each choice, explaining which debts may be discharged and which assets might be protected.

Representation and Advocacy

Navigating communication with creditors and legal proceedings can be intimidating without representation. Bankruptcy attorneys advocate for clients in court, during negotiations, and with creditors to achieve the most favorable outcome possible.

Strategies for Debt Resolution

Debt Negotiation

Debt negotiation involves reaching agreements with creditors to settle debts for less than the full amount owed. This strategy hinges on effective communication and the ability to demonstrate financial hardship. Attorneys often negotiate on behalf of clients, leveraging professional relationships to secure optimal terms.

Debt Consolidation

Debt consolidation simplifies financial management by combining multiple debts into one monthly payment. This method typically reduces interest rates and extends repayment terms. While this approach doesn’t lower the total debt, it alleviates cash flow constraints and ensures timely repayments.

Structured Repayment Plans

For individuals and businesses alike, structured repayment plans provide a systematic way to repay financial obligations. These plans are often court-approved, ensuring the consistency and legality of repayment commitments.

Bankruptcy Proceedings

Filing for bankruptcy may be the best option in cases where debt exceeds the debtor’s ability to repay. Attorneys guide clients through filing for Chapter 7 (liquidation) or Chapter 13 (reorganization), making the process as streamlined as possible.

Debunking Common Misconceptions About Debt Resolution

Myth 1: Bankruptcy Irreversibly Destroys Financial Standing

While bankruptcy may appear to negatively affect credit initially, it often serves as a stepping stone toward greater financial stability. Many individuals and businesses find their finances recover well following a successful debt resolution strategy.

Myth 2: Bankruptcy is the Only Option

Although bankruptcy is a common tool for resolving significant debt, it isn’t the only solution. Attorneys can often find viable alternatives tailored to specific circumstances, preserving clients’ credit scores and financial stability.

Myth 3: Seeking Legal Help is Too Expensive

While hiring an experienced bankruptcy attorney involves upfront costs, the long-term benefits of effective debt resolution far outweigh these expenses. Attorneys often identify overlooked options that can save clients significant sums over time.

Proactive Steps to Take Now

Resolving debt strategically requires timely action and preparation. Individuals or businesses navigating financial difficulties can take these proactive steps to streamline the process:

- Gather Financial Records: Compile detailed documentation of debts, income, and assets to provide an accurate overview of the financial situation.

- Seek Professional Advice: Consult with a bankruptcy attorney to evaluate your options and develop a clear debt resolution strategy.

- Understand Your Rights: Educate yourself about applicable consumer protection laws to ensure fair treatment during the debt resolution process.

Reclaim Your Financial Future

Navigating debt challenges without a solid plan can lead to stress, uncertainty, and setbacks. A strategic approach to debt resolution, supported by insights from experienced bankruptcy attorneys, empowers individuals and businesses to address financial difficulties head-on. Whether through negotiations, consolidated repayment plans, or court-driven resolutions, expert guidance ensures a path toward financial recovery tailored to your needs.

For those feeling overwhelmed by financial obligations, now is the time to act. Consult with a qualified bankruptcy attorney to explore your options and reclaim control over your financial future.