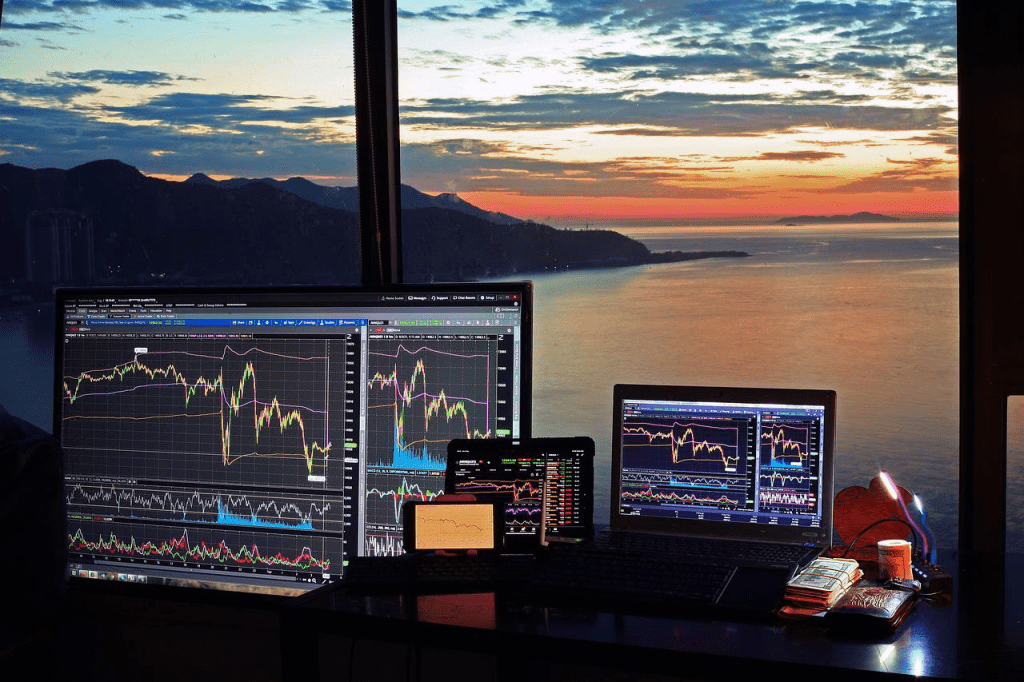

Financial trading consists of buying and selling shares, currencies, options, and so on, in a short term or even within the day. Traders try to take advantage of the small fluctuations in prices to make a profit, and they often assume high risks to ensure maximum profit. Thanks to technology, trading has become much more accessible to everyday people.

So, if you are looking for tips that will help you start trading or improve your trading strategy, read below.

1. Don’t Rely Simply on Luck

Like with anything in life, the key to success in the stock market is often your willingness to continuously do research and learn. Thankfully, nowadays, traders can take advantage of various useful tools that can help traders make better and more informed decisions. And it’s a good idea to try to take advantage of them. Furthermore, it’s very important to find a trading strategy suitable for your needs and stick with it. Using an intuitive implied volatility chart, for instance, can help you develop your trading strategy. Not only will it help you find the right stocks for your portfolio, but it will also help you optimize and refine your strategy over time. Stock screening is another great strategy to help you identify stocks that match your criteria and can be a great source of knowledge about the stock market. You can go here for more information on how stock screening can help you make sound decisions. If this sounds like too much, you can always work with an experienced financial advisor who will guide you in building a profitable and sustainable trading strategy.

When you start trading, it’s easy to be influenced by fear of loss or to resort to impulsive sales, among other things. Instead of giving in, you should stick to your defined strategy. This way you won’t rely on emotions for your decision-making process, and you can stay more objective when faced with market movements. And all of this can be crucial to your success.

2. Use Real-Time Predictive Analysis

Being able to review data from several relevant sources can make a huge difference in your ability to make good financial trading decisions. Thanks to data science, this has become possible in today’s world of trading for individual traders, and even for inexperienced individuals who are just starting to trade. One of the most life-altering technological advancements, with countless applications across industries and in our daily lives, machine learning can be used in trading.

A lot of the decisions in trading are made based on certain patterns that can be identified using volatility, price movements, volume oscillation, price trends, and so on. Thanks to algorithms designed to analyze a large amount of data from many different sources in real-time, as well as recognize patterns, the ability to perform such analysis and locate those patterns, which used to take a lot of time and was only possible for institutional traders and big funds, nowadays aren’t just their privilege.

3. Follow Financial News and Track Trends

Following financial news reports can help you understand what could influence the market and cause movements every day. After each trade, spend some time contemplating the situation and analyze your own trades. This can help you determine the reasons why a trade was successful and profitable or not. If you’ve lost some money, ask yourself if this has happened because you didn’t stick to your strategy, did you make a rash decision, or was it something completely out of the blue?

Being always right is impossible but understanding why you were wrong is not only possible but also recommendable. Regardless of the outcome of a trade, analyze your results, the conditions, and the causes. This will help you become more critical and make better decisions in the future.

4. Train and Test

Thanks to technology, data science, and how easily accessible they are for most people, testing has never been easier. One way to do this is to create a machine learning model, using historical data. After that, you can train your model and test it to see whether it performs well or not. Machine learning models can help traders predict future market movements, based on past data.

Moreover, set up a demo account and start trading stocks, currencies, or commodities without any financial risk. Instead of using your demo account to exclusively practice trading strategies, you can also use it to get used to the software you are using.

5. Know That Sometimes You Will Lose

You can’t expect that you can find a way to always win in financial trading. You can’t hope to find a magical formula, or rely on your lucky star to bring help you make the right decision. Luck, as well as hope, should stay out of your decision-making process when it comes to trading. The thing is, in trading, everyone will lose money at some point.

Conclusion

Trading isn’t simple but it can be very profitable. If you want to become a better trader these are only 5 of the many steps you must take. So, before you begin trading, read them, see which ones make sense for you specifically, and create a trading strategy.