Great business ideas perish due to a lack of startup funds. Also, studies have shown that about 80% of businesses crash in less than 2 years of operation. Most times, this crash is due to the unavailability of funds needed to keep the business running.

So from the time you get the business idea to when it grows, you need adequate funding to support your vision. So, this article shares quick tips to help you fund your business startup. Moreover, we recommend Loan Corp for loans covering both domestic and commercial use.

5 tips to get quick funding for your startup

- Self-funding

When starting a business, it’s not always best to start getting loans. You can’t guarantee the business’s success, and if it becomes unsuccessful, it will land you in debt. To avoid such risky situations, the best way to start up the business is with the little money you can raise independently.

Sometimes, you may need to scrap from your savings or get money from friends and relatives. Money from these sources comes much easier, and the interest (if any) will be flexible. This will help you grow the startup to a good point where it will draw the attention of investors. But for big businesses, this may not work.

- Use online platforms

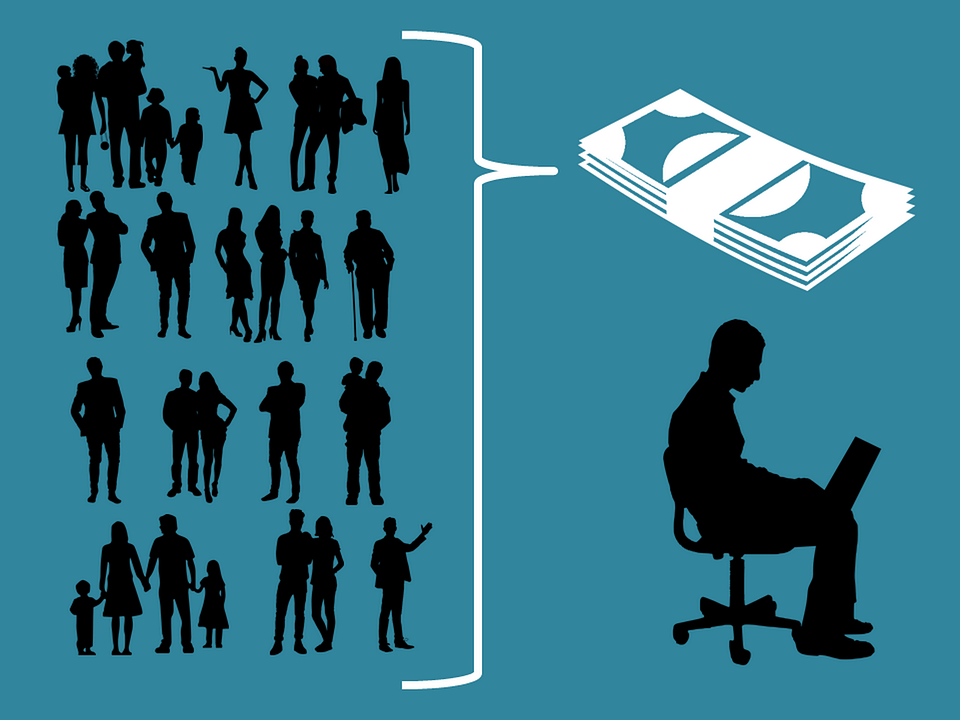

Some businesses will require significant capital for startup. As such, you may need money from a lot of investors at the same time. In this case, crowdfunding may be just the way out, and several online crowdfunding platforms exist. Crowdfunding helps you to get small investments from many individuals.

Some best-rated crowdfunding platforms are Indiegogo, Mightycause, GoFundMe, and Patreon. While crowdfunding platforms can help you grow substantial funds, they also increase exposure and build an audience for your business. Moreover, crowdfunding gives you a clue of how much interest people have in your business.

- Be ready to sacrifice the owner’s equity.

If both plans above don’t work in your favor, you may need to try angel investors. These are wealthy businessmen and women capable of supporting viable businesses with the funding they need to kick off. But their investment is usually for convertible debt or a part of ownership equity.

These investors may sometimes come as a group. Your angel investor could also be a single businessman or woman. Once an angel investor agrees with you, you’ll both draw up a contract or term sheet. The term sheet usually contains the agreements you both reach, such as governance parameters, investor rights, equity percentages, and optional exit strategy for the investor.

- Request for loans

You’ll need to maintain a good credit score to get the best out of this. A good credit score will influence the amount of money a bank can give you as a loan. In addition, maintaining a good credit score may impact the loan terms and lower the interest rates.

However, getting a loan from a bank may be challenging as the requirements for qualification are usually too high. Alternatively, you could also contact lending companies. However, you’ll need to do some background research about any company you’re borrowing from, as some of these companies tend to be predatory.

- Participate in competitions

Winning in a competition is another way to raise quick funds for your start-up. However, it’s not always free because you’ll have to compete to earn it. Some notable business plan competitions that can help you fund your startup include Get Seeded, Global Student Entrepreneurs Awards, MIT 100K, and Washington State University business plan competitions.

Prizes received from such competitions could be as high as $50,000. Eligibility requirements could be university studentship alongside a viable business idea. The competition will judge you based on criteria such as feasibility, creativity, quality, and execution of your business idea/plan.

Conclusion

Funding your startup may not be much of a worry if the business plan is creative enough. The most recommended way of doing this is by bootstrapping. This involves you doing your thing all by yourself without having to get loans from anyone.

This helps you stay true to your business goals and objectives without pressure from anyone. If you must get loans from anywhere for your business, we recommend doing background research about the lenders. This will help you avoid falling into the hands of ravenous predators.