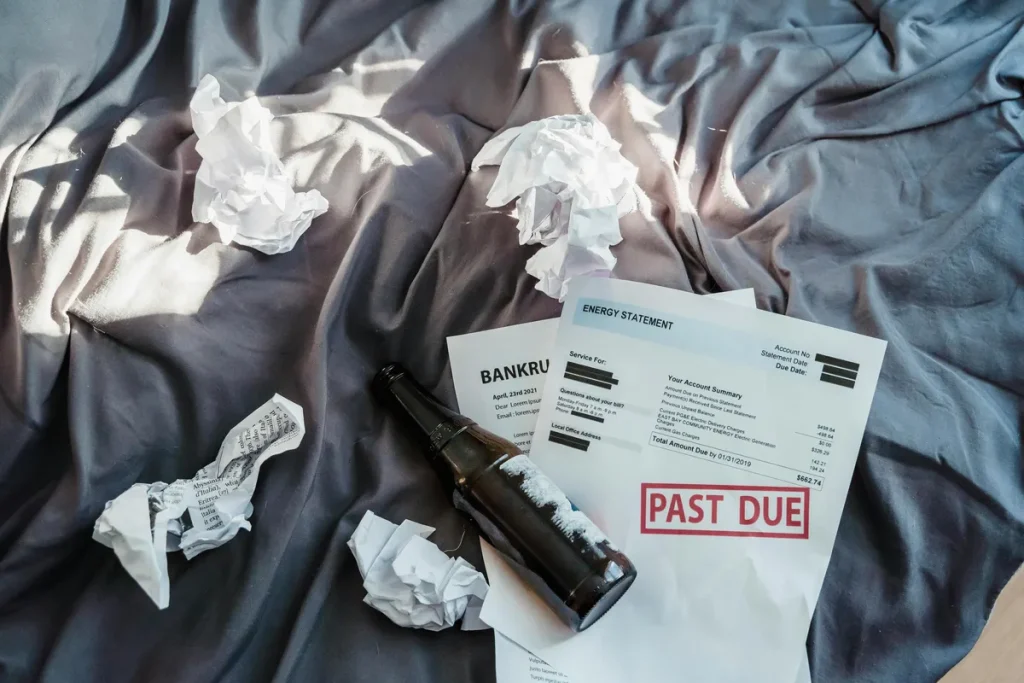

Filing for bankruptcy can feel overwhelming and intimidating, especially when navigating the complexities of the legal process. However, hiring a specialized bankruptcy attorney can provide clarity, guidance, and confidence during these challenging times. This blog explores the benefits of working with a dedicated bankruptcy attorney and how their expertise can play a crucial role in safeguarding your financial future.

Understanding the Role of a Bankruptcy Attorney

What Does a Bankruptcy Attorney Do?

A bankruptcy attorney specializes in assisting individuals and businesses in managing debt through legal measures outlined by the Bankruptcy Code. Their role goes beyond simply filing paperwork; they are legal advocates equipped to assess your financial situation, provide advice, and guide you through each step of the bankruptcy process.

Many individuals assume bankruptcy is a straightforward process of liquidating assets and discharging debt; however, this is far from the full picture. A knowledgeable attorney ensures that your rights are protected, makes the process more efficient, and helps you achieve a favorable resolution.

Why Expertise Matters in Bankruptcy Cases

Tailored Advice Based on Your Circumstances

Bankruptcy cases are not one-size-fits-all. Different chapters of bankruptcy, such as Chapter 7, Chapter 13, or Chapter 11, cater to distinct financial situations. An experienced bankruptcy attorney evaluates your circumstances and ensures that the appropriate chapter is selected, maximizing benefits such as debt discharge, asset protection, or business restructuring.

Without professional guidance, individuals may unknowingly select the wrong chapter, potentially missing opportunities to retain assets or inadvertently agreeing to unfavorable repayment terms.

Familiarity with Legal Processes

The bankruptcy process is full of legal formalities, regulations, and deadlines. Missing a court submission deadline or filing inaccurate documentation can cause delays or even result in case dismissal. An attorney handles all the paperwork, gathers essential documentation, and adheres to filing deadlines, ensuring compliance with bankruptcy laws. This attention to detail eliminates unnecessary stress and inefficiencies.

Ensuring Protection from Creditors

Dealing with relentless calls from creditors adds unnecessary pressure during already difficult times. Once you file for bankruptcy, an automatic stay goes into effect, stopping most collection activities. A bankruptcy attorney ensures that this stay is implemented and enforced, helping you breathe a sigh of relief.

If creditors continue to harass you illegally, your attorney can take necessary legal action to hold them accountable, further protecting your financial and emotional well-being.

Benefits of Hiring a Specialized Bankruptcy Attorney

Effective Debt Management Strategies

An experienced bankruptcy attorney, like those at Credit Solutions, doesn’t just help you file for bankruptcy; they provide strategic guidance on managing debts long-term. Whether it’s negotiating better repayment terms, presenting alternatives to bankruptcy, or identifying debts that can and cannot be discharged, their expertise lays the groundwork for a stronger financial future.

Safeguarding Assets

One of the most significant benefits of hiring a specialized bankruptcy attorney is their ability to help protect your essential assets. Bankruptcy exemptions allow you to retain specific properties such as your home, car, or retirement accounts. An attorney is well-versed in these exemptions and ensures they are applied effectively in your case.

Without legal expertise, you may risk losing assets unnecessarily—a mistake that can leave you in a worse financial position than before.

Access to Insider Knowledge

Bankruptcy attorneys have extensive experience working with local courts, trustees, and creditors. They understand the preferences, tendencies, and procedures of these stakeholders, offering an advantage when presenting your case. This insider knowledge allows them to anticipate challenges and proactively address them before they escalate.

Navigating Complex Cases with Confidence

Handling Chapter 11 and Business Bankruptcy

For business owners, bankruptcy introduces additional layers of complexity. Chapter 11, often referred to as “reorganization bankruptcy,” requires a thorough analysis of your business’s financial state and a detailed restructuring plan to present to creditors.

An attorney ensures the restructuring plan is in compliance with regulations and improves the likelihood of creditor approval. This guidance can be the difference between closing business doors permanently and regaining financial stability.

Dealing with Unforeseen Complications

Bankruptcy cases often come with unexpected hurdles, such as creditor challenges or disputes over asset valuations. Specialized attorneys have the experience needed to tackle these roadblocks, allowing you to focus on rebuilding your financial future instead of managing legal wrangling.

Building a Path Toward Financial Recovery

While bankruptcy may feel like the end of the road, it’s often a chance to start fresh. A bankruptcy attorney plays a pivotal role in helping you transition from financial hardship to stability. Their expertise doesn’t stop at filing paperwork—they provide valuable advice on steps to rebuild credit, manage expenses, and avoid over-indebtedness in the future.

Through tailored strategies and a support system designed to help you succeed, an attorney gives you the tools needed to create a sustainable financial foundation post-bankruptcy.

Take Control of Your Financial Future

Bankruptcy can feel overwhelming, but you don’t have to face it alone. Hiring an experienced bankruptcy attorney offers you the expertise, guidance, and peace of mind needed to successfully navigate this complex process. From protecting your assets to ensuring compliance with legal requirements, their contributions can make all the difference in securing your financial future.

If you’re considering bankruptcy or simply exploring your options, consult a trusted bankruptcy attorney today. Taking proactive steps now can lead to lasting financial security tomorrow.