As the ongoing pandemic continues to propel digital e-commerce and financial transactions, online payments are fast gaining acceptance and trust from Filipinos. This is a key trend observed by the newly rebranded Bayad, the country’s biggest and widest multi-channel payment platform.

Crucial in this partnership is the continued growth of the fintech ecosystem which Bayad actively supports with the end goal of bringing financial services closer to Filipinos. Joining forces with Bayad is Ayannah, a leading provider of affordable and accessible digital financial services for the emerging class, many of whom are unbanked and are just coming out of the base of the pyramid.

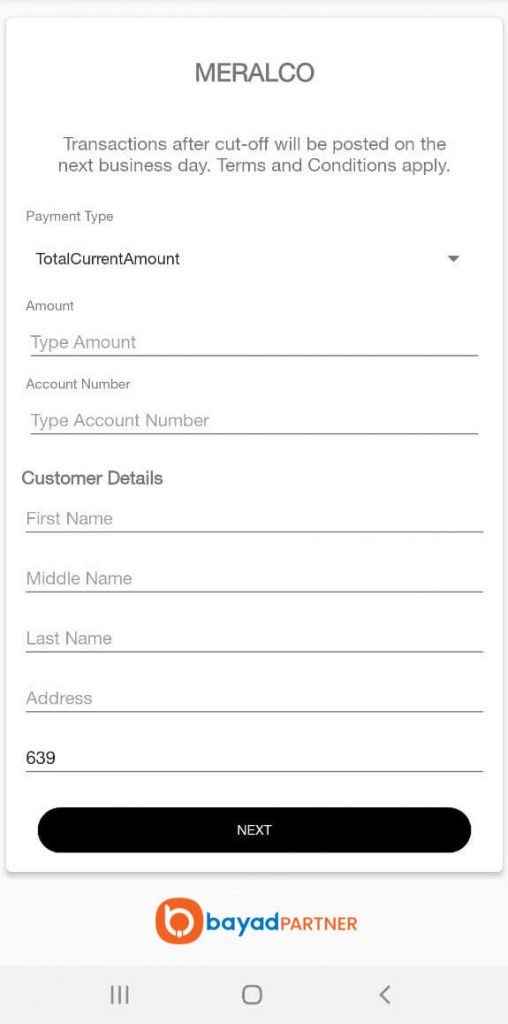

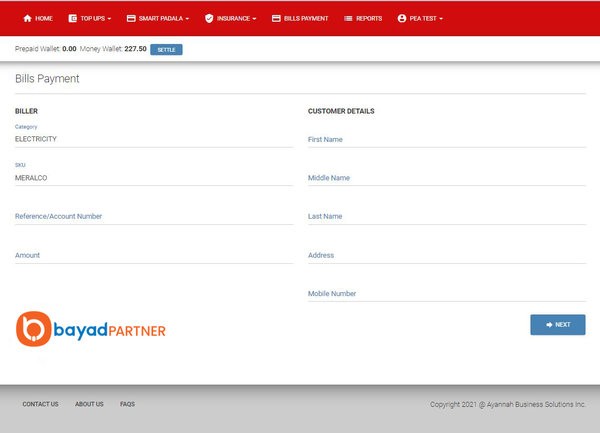

With the common goal of bridging gaps in the current financial landscape, Bayad and Ayannah are teaming up to be able to offer bills payment services through its award-winning Sendah Direct app which is used by several thousand agents who belong to several remittance and payment networks. With a full stack of market-proven digital financial services (DFS), they are also ahead of the market with their other apps, catering to the emerging middle-class markets including overseas Filipino workers, as well as small and medium enterprises for cross-border e-commerce, remittance, insurance, lending, and credit scoring services, such as Sendah Direct, Sendah Remit, Kaya Credit, Sendah, and Sendah Express.

The partnership between Bayad and Ayannah is seen to spur financial inclusion and literacy as the companies enable greater access to products and services that will help customers improve their economic well-being and quality of life.

According to Miguel Perez, Ayannah CEO, “Bills payment is an important, recurring transaction that we all have to do. It’s a vital component of any digital solution that’s why we partnered with Bayad. But what’s most exciting is that payment transactions provide us a richer picture of the Filipino which can inform and guide the creation of more responsive and affordable financial services.”

Bayad President and CEO Lawrence Ferrer pointed out that “I believe in Ayannah’s efforts in democratizing financial services. We share the mission of attaining inclusivity and allowing Filipinos to develop trust in digitized transactions. Also, as leading fintech players we both see the opportunity in working on credit scoring, customer profiling, and engagement to benefit more customers in the future. We are always guided by our belief that Filipinos deserve to be rewarded for their hard work, so we always think of ways to make payments and other financial services simple, fast, and readily available for our kababayans, anytime, anywhere.”

Mr. Ferrer emphasized that Bayad has been able to rapidly grow its network and channel partners because its business model has been strategically designed to complement other financial services providers. In its recent rebranding, Bayad committed to being bigger, better, and younger as it foresees the evolution of physical and digital payments.

Seeing that cash remains to be king especially in rural areas, Bayad continues to boost its over 45,000 over-the-counter payment touchpoints nationwide. At the same time, its digital presence is reinforced by the all-in-one pera transaction mobile app called Bayad, and the new web-based one-stop-shop for essential bills, Bayad Online.