Fundraising can be rather challenging, especially for startups that lack a track record and an established network of investors. In the process of building a long list of investors, contacting them, and then making a short list, founders can lose focus on their startup and lose themselves in capital raising. That is where investor databases come in handy. However, it’s not that simple: many databases are expensive or focus on certain regions excluding specific ones, or are just not user-friendly. Private Equity List has created its own solution to solve these problems.

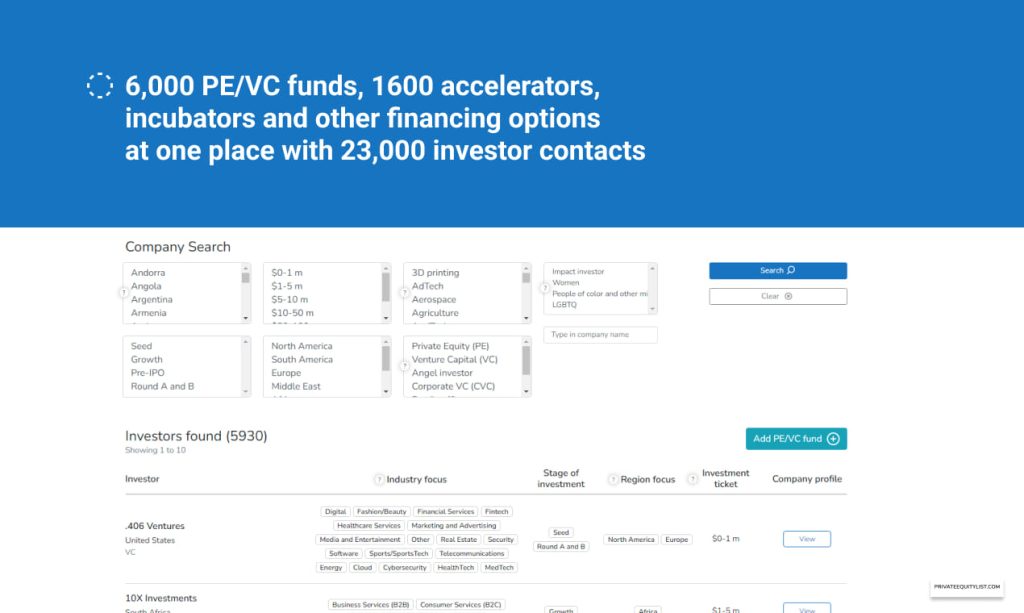

Private Equity List is a platform where you can search among 6,000 funds, 1,600 accelerators and incubators, and 23,000 investor contacts. It’s easy to use and has a focus on the Middle East, Latin America, Africa, Asia and other less popular investment regions. Ever tried finding all investment funds in Malaysia?

The platform has 7 types of filters: fund country, industry and region focus, equality/minority support, stage of investment, investment ticket and investor type.

Apart from more classic PE/VC funding, there are many alternative financing options: venture debt, SME financing, crowdfunding/crowdlending, revenue-based financing, SBA loans and ABL. PE/VC is not always the best option.

Although there are many popular funds from the US and Europe on the platform, Private Equity List tries to focus on small/mid-cap funds, which gives startups more chances to get less competition, get seen and ultimately receive the investment.

The platform has a subscription model: $25 per month for full access to the database with detailed info about investors, and all their contacts (names, positions, e-mails and LinkedIn) are available for $79 per month. You can try Private Equity List here: privateequitylist.com/search