Fresh research from Kaspersky reveals e-wallet and mobile banking adoption trailing closely behind cash use in the region

Is cash still king in Asia Pacific (APAC)?

Kaspersky’s recent study showed it still is, but may not be for long.

Titled “Mapping a secure path for the future of digital payments in APAC”, the research studied local users’ interactions with the available online payments in the region and examined their attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology.

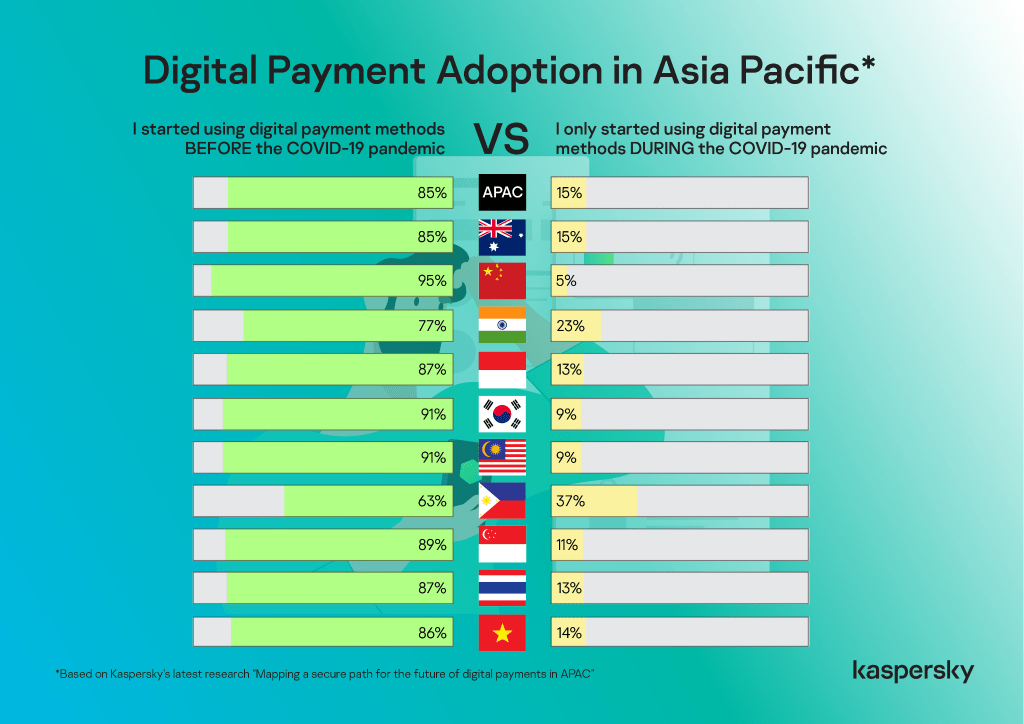

One of its key findings showed that a great majority (90%) of the Asian respondents has used mobile payment apps at least once in the past 12 months, confirming the fintech boom in the region. Nearly 2 in 10 (15%) of which only started using these platforms after the pandemic.

The Philippines logged the highest percent of new e-cash adopters at 37%, followed by India (23%), Australia (15%), Vietnam (14%), Indonesia (13%), and Thailand (13%). The lowest number of first-time online payment users are China (5%), South Korea (9%), and Malaysia (9%).

China has been a notable leader in mobile payments in APAC. Even before the pandemic, its top local platforms, Alipay and WeChat Pay, have witnessed significant mass adoption and served as an example to follow for other Asian countries.

“Data from our fresh research showed that cash is still king, at least for now, in APAC with 70% of the respondents still using physical notes for their day-to-day transactions. However, mobile payment and mobile banking applications are not far behind with 58% and 52% users utilizing these platforms at least once a week up to more than once a day for their finance-related tasks. From these solid statistics, we can infer that the pandemic has triggered more people to dip their toes into the digital economy, which may fully dethrone cash use here in the next three to five years,” says Chris Connell, Managing Director for Asia Pacific at Kaspersky.

Safety and convenience triggered more users in APAC to embrace financial technologies. More than half of the survey pollees noted that they started using digital payment methods during the pandemic as it is safer and more convenient than making a face-to-face transaction.

Respondents also cited that these platforms allowed them to make payments while adhering to social distancing (45%) and that these are the only way they can do monetary transactions during the lockdown (36%). For 29% of users, digital gateways are more secure now compared to pre-COVID-19 era and the same percentage also appreciate the incentives and rewards providers offer.

While only a small fraction, friends and relatives (23%) still influenced new adopters as well as the local government (18%) promoting the use of digital payment methods.

When asked about their reservations prior to using mobile banking and payment apps, first-time users admitted their fears – afraid of losing money online (48%) and afraid of storing their financial data online (41%). Almost 4 in 10 also revealed they do not trust the security of these platforms.

More than a quarter also find this technology too troublesome and requires many passwords or questions (26%), while 25% confessed their personal devices are not secure enough.

“To drive a secured digital economy forward, it is important for us to know the pain points of our users and identify the loopholes that we need to address urgently. It is a welcome finding that the public is aware of the risks that comes with online transactions and because of this, developers and providers of mobile payment applications should now look into the cybersecurity gaps in each stage of the payment process and implement security features, or even a secure-by-design approach to fully gain the trust of the future and existing digital payment adopters,” Connell adds.

To help users in APAC embrace digital payment technologies securely, Kaspersky experts suggest the following:

- It is better to be safe than sorry – beware of fake communications, and adopt a cautious stance when it comes to handing over sensitive information. Do not readily share private or confidential information online, especially when it comes to requests for your financial information and payment details.

- Use your own computer and Internet connection when making payments online. As like how you would only make purchases only from trusted stores when shopping physically, translate the same caution to when making payments online – you’ll never know if public computers have spyware running on them recording everything you type on the keyboards, or if your public Internet connection has been intercepted by criminals waiting to launch an attack.

- Don’t share your passwords, PIN numbers or one-time passwords (OTPs) with family or friends. While it may seem convenient, or a good idea, these provide an entryway for cybercriminals to trick users into revealing personal information to collect bank credentials. Keep them to yourself and safeguard your private information.

- Adopting a holistic solution of security products and practical steps can minimize the risk of falling victim to threats and keeping your financial information safe. Utilize reliable security solutions for comprehensive protection from a wide range of threats, such as Kaspersky Internet Security, Kaspersky Fraud Prevention and the use of Kaspersky Safe Money to help check the authenticity of websites of banks, payment systems and online stores you visit, as well as establish a secure connection.

To read the full report, please visit https://kas.pr/b6w8.

Methodology

The Kaspersky “Mapping a digitally secure path for the future of payments in APAC” report studies our interactions with online payments. It also examines our attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology.

The study was conducted by research agency YouGov in key territories in APAC, including Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam (10 countries). Survey responses were gathered in July 2021 with a total of 1,618 respondents surveyed across the stated countries.

The respondents ranged from 18-65 years of age, all of which are working professionals who are digital payment users.

Through this study, when the behavior of the population of a market is generalized, it is in reference to the group of respondents sampled above.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative security solutions and services to protect businesses, critical infrastructure, governments and consumers around the globe. The company’s comprehensive security portfolio includes leading endpoint protection and a number of specialized security solutions and services to fight sophisticated and evolving digital threats. Over 400 million users are protected by Kaspersky technologies and we help 240,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.