Kaspersky shares what can happen

The recent spate of selling and even rental of verified digital wallets in the country should not be taken lightly. It is, in fact, alarming because its owners or account holders risk losing their identities with far-reaching consequences, according to cybersecurity and digital privacy company Kaspersky.

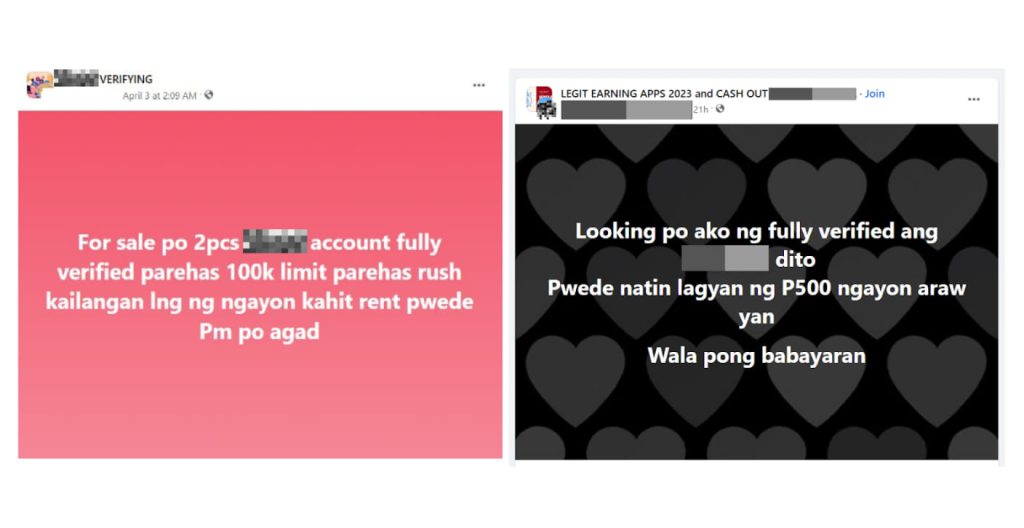

Since 2022, the local media have been reporting various apprehensions by police authorities of individuals allegedly involved in buying and selling of verified digital wallet accounts. Registered SIM accounts with verified digital wallet accounts are currently being bought for P350 each. On social media, the rates even go as low as P150 per account. These are then sold for an average of P600-P800 each.

This kind of transaction is a cybercrime offense under Philippine laws. If proven guilty, both seller and buyer are up for some jail time and penalties from P100,000 to P500,000.

But what’s stored in a digital wallet?

A digital wallet is usually loaded with personal details of its owner such as full name, date of birth, nationality, phone number, email address, and mailing address. Once verified by the digital wallet company as a legitimate account, all financial transactions can be performed within the digital wallet app.

The transaction limit varies but the maximum amount that can be received or sent per account is as high as P500,000, bypassing the use of credit and debit cards that are regulated and normally require security checks.

Mobile digital wallets are a popular alternative financial service among Filipinos. Unfortunately, some digital wallet users think that selling their account isn’t really a big issue. They believe their accounts are not tied to any bank accounts with a lot of funds so there is nothing to extort from them. And getting a new SIM is cheap and easy and verifying their digital wallet accounts is hassle-free.

“We’ve witnessed how the Filipinos embraced the cashless lifestyle during the pandemic, out of necessity. The ease of access and convenience of digital wallets made everyone quite comfortable, with some now selling, renting out or even loaning their verified accounts. By doing so, cybercriminals do not need to put much effort into phishing anymore as Filipinos are practically giving away their personal data for a song, which is really dangerous,” says Yeo Siang Tiong, General Manager for Southeast Asia at Kaspersky.

“As sellers or lenders of their own digital wallet accounts, not only would they get into trouble with the law. Losing their identities is also very likely especially when their data gets into the hands of scammers. With enough information from you, scammers can already set up other financial accounts using your name and use your identity to benefit them. Possible scenarios would be getting harassed by a collection agent for a debt you’ve never owed. It could also mean losing out on job or education opportunities just because your name appeared with an unpleasant digital profile when searched,” adds Yeo.

What other damage can data thieves do?

By selling your verified digital wallet, you are essentially handing out your data to cybercriminals and helping them carry out their evil activities.

With your confidential information in their hands, data thieves can:

- Make purchases on your behalf

- Use your personal details in online gaming. Cybercriminals use stolen identities for doxing (publishing your home address and phone number online for profit, fun, or humiliation) and swatting (reporting a fake emergency to law enforcement agencies to come to your place to intimidate you)

- Use your personal information in online gambling. Fraudsters create networks of thousands of synthetic accounts, normally using stolen personal data and credit card information to accumulate bonus points and redeem their “winnings”. This particular type of fraud is extremely common in online poker and blackjack, where the result can be manipulated through game strategy.

- Add themselves or an alias they can control as an authorized user so it’s easier to use your credit.

- Use and abuse your Social Security number. Scammers may be able to take out loans and claim benefits under your name.

- You may be banned from using the services of your favorite digital wallet company if your name appears to have availed of its loan services and that you cannot pay.

- Sell your information to others who will use it for malicious purposes. Buying and selling of stolen personal information is big business on the dark web, the non-visible Web that can be accessed only by a specialized browser where cybercriminals provide illegal services to one another. Back in 2018, data from Kaspersky showed that criminals can sell someone’s complete digital life in the dark web for less than $50 (or P2,761, today’s forex). In 2020, the cybersecurity company shared that personal identity details such as full name, date of birth, email and mobile can fetch from $0.5 to $10 each (or P27.62 to P552.33).

Is there still a way to save your stolen identity?

Once you have handed over your SIM account with your personal data in it, it is not easy to undo it. Experts suggest replacing your email address and telephone address as well as changing all affected passwords in all of your social media and financial accounts. If you believe you have been victimized by identity fraud, you can lodge a complaint through the Cybercrime Investigation and Coordinating Center (CICC) here.

How else to protect yourself from identity theft?

- Keep data to a “need-to-know” basis. If someone is asking for your personal information, ask why they need it and how they will use it.

- Bank safely. Make sure that you log into financial websites using a secure connection all the time.

- Know who you’re dealing with. If you are requested for your personal or financial information, find out who they are, what company they represent, and the reason for the request. Contact the company to confirm before disclosing any of your personal data.

- Secure the data in your device. Use a security software to maximize your online safety, whether you transact using your personal details on your laptop, PC or mobile phone.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect businesses, critical infrastructure, governments and consumers around the globe. The company’s comprehensive security portfolio includes leading endpoint protection, specialized security products and services, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. Over 400 million users are protected by Kaspersky technologies and we help over 220,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.